Business property depreciation calculator

Calculator Depreciation Estate Commercial Real. Enter the purchase price of a business asset the likely sales price and how long you will use the asset to compute the annual rate of depreciation of that asset or piece of equipment.

Macrs Depreciation Calculator With Formula Nerd Counter

The short answer is no you cannot deduct the 40000 down payment on your 2012 income tax return.

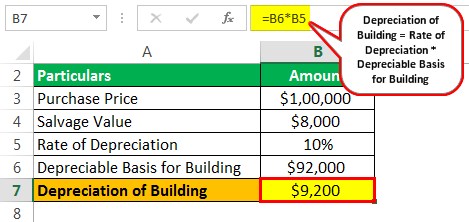

. D i C R i. What you need to do is depreciate the entire cost of the building over. Depreciation is a method for spreading out deductions for a long-term business asset over several years.

How to Calculate Depreciation on a Rental Property. This is the first Calculator to draw on real properties to determine an accurate estimate. Tax provisions accelerate depreciation on qualifying business equipment office furniture technology software and other business items.

The calculator should be used as a general guide only. Business vehicle depreciation calculator. There are many variables which can affect an items life expectancy that should be taken into.

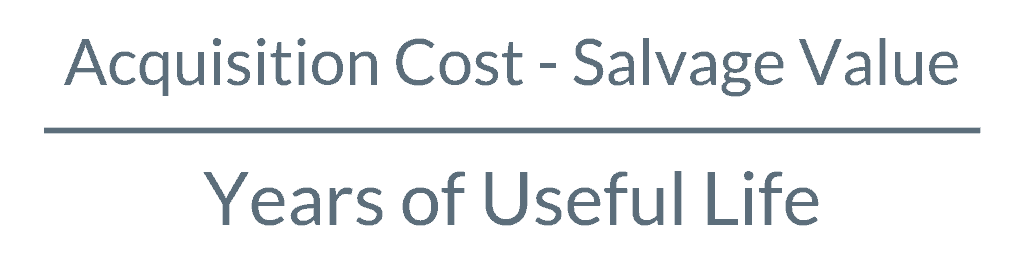

Commercial and residential building assets can be depreciated either over 39-year straight-line for commercial property or 275-year straight line for residential property as dictated by the. The calculator should be used as a general guide only. The basic way to calculate depreciation is to.

This calculator is geared towards residential rental property depreciation but you can still use it to show the depreciation of commercial real estate for one or more years. This calculator will help you estimate your capital gains tax exposure and the net proceeds from the sale of your asset investment property or otherwise. It was updated in 2013 to reflect.

It is determined based on the depreciation system GDS or. The MACRS Depreciation Calculator uses the following basic formula. Where Di is the depreciation in year i.

Depreciation calculator companies act 10. First one can choose the straight line method of. This calculator is geared towards residential rental property depreciation but you can still use it to show the depreciation of.

The total cost of the work. The bonus depreciation calculator will provide a good preliminary estimate of the extra depreciation for your building. It provides a couple different methods of depreciation.

Straight Line Depreciation Step. Many companies in Australia offer their services to calculate commercial property depreciation and they also help you until you dont get relief. Divide the total value by 39 to get your annual depreciation on a.

BGC Partners NASDAQBGCP is a combined interdealer. However there are a variety of factors that need to be. The property is 3-year property.

Calculate the total cost basis of the commercial property you are depreciating. This depreciation calculator is for calculating the depreciation schedule of an asset. C is the original purchase price or basis of an asset.

Real estate depreciation is a complex subject. It allows you to figure out the likely tax depreciation deduction on your next investment property. The recovery period of property is the number of years over which you recover its cost or other basis.

A rental property depreciation calculator is right for you if you own one or more residential rental property and want to calculate your expected depreciation on an annual.

Free Macrs Depreciation Calculator For Excel

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Depreciation Schedule Formula And Calculator Excel Template

How To Use Rental Property Depreciation To Your Advantage

Depreciation Calculator Depreciation Of An Asset Car Property

Straight Line Depreciation Calculator Double Entry Bookkeeping

Guide To The Macrs Depreciation Method Chamber Of Commerce

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Calculate Depreciation Expense

1 Free Straight Line Depreciation Calculator Embroker

Download Depreciation Calculator Excel Template Exceldatapro

Macrs Depreciation Calculator Straight Line Double Declining

Straight Line Depreciation Calculator And Definition Retipster

Depreciation Of Building Definition Examples How To Calculate

Depreciation Schedule Template For Straight Line And Declining Balance

Straight Line Depreciation Calculator And Definition Retipster

Macrs Depreciation Calculator Irs Publication 946